Grant, tax exemption and/or leasing, with percentage rates up to 75% of the budget

The 2nd Call for Proposals of the “Processing – Supply Chain“ scheme and the “Enhancement of Tourism Investments“ scheme of the Development Law 4887/2022 has been published.

The date for the submission of applications for investment projects under the “Processing- Supply Chain” scheme is the 1st of June 2023, and the closing date of the submission cycle is the 29th of December 2023, while applications for the “ Enhancement of Tourism Investments” scheme start on the 12th of June 2023 and the closing date of the submission cycle is the 29th of December 2023.

Meanwhile, the call for the “Just Transition Plan” scheme of the Development Law 4887/2022 for investment projects in a number of sectors of activity in the municipalities of Western Macedonia and Megalopolis is in pre-publication. A grant of up to 70% is foreseen for all enterprises regardless of size. Applications will be submitted on a first-come, first-served basis and until exhaustion of the scheme’s budget.

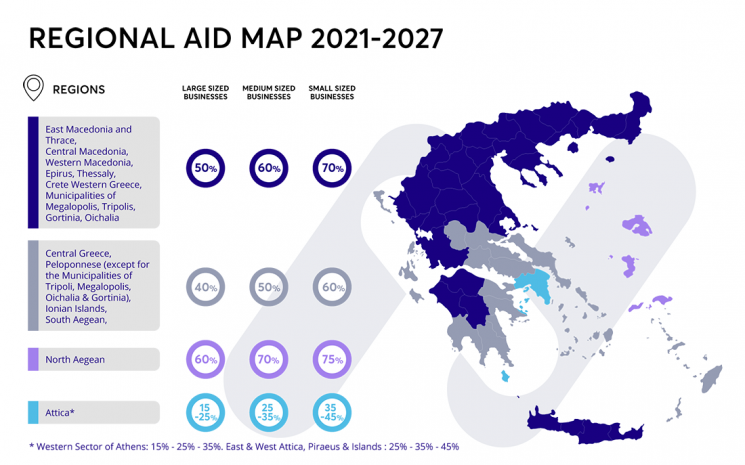

Aid Rates

The aid intensity is the maximum amount of State aid that can be granted per recipient, expressed as a percentage of the eligible investment costs. The detailed percentages of the Regional Aid Map are presented for each Regional Unit in the following map:

* For the North Aegean Region, the maximum aid percentage is set for large companies at 55%, for medium-sized companies at 65% and for small and very small companies at 75%.

Eligible beneficiaries

- Commercial company

- Cooperative

- Social Cooperative Enterprises, Agricultural Cooperatives. Producer Groups, Rural Partnerships.

- State and municipal enterprises and their subsidiaries under certain conditions

- Sole proprietorship with a maximum eligible investment project cost of 200.000€ and only for the scheme “Agri-food – Primary Production and Processing of Agricultural Products – Fisheries”

Aid Schemes

Digital and technological business transformation

The relevant investment projects concern the technological upgrading of existing units and aim to introduce new digital operations and processes, combining production methods with modern information and communication technology.

Green transition – Environmental Upgrade for businesses

It applies to investment projects of businesses that focus on environmental protection, as well as other existing business activities, provided that costs are incurred for energy efficiency and environmental protection measures.

New Entrepreneurship

Investment projects for activities in primary production, processing of agricultural products, fisheries, research and applied innovation, digital and technological transformation, processing and the supply chain, to be carried out by Micro and Small Enterprises under establishment, in whose corporate capital only natural persons participate, and which are a) have no previous participation in companies, with the exception of holding shares of companies listed on the Athens Stock Exchange (ASE), b) have no previous business activity and c) meet the income criteria specified in the relevant calls.

Just Transition Plan

It concerns investment projects to be carried out in the areas of the Territorial Just Transition Plans. See here for more information on this scheme.

Research and applied innovation

The objective is for the projects to contribute to the development of technology or the provision of services through the technological development, the production of innovative products or the introduction of procedural or organizational innovations, the utilization of research results, the increase in employment and the creation of high added value jobs.

Agri-food – Primary Production and Processing of Agricultural Products – Fisheries

The aid is intended for investment projects in the sectors of primary agricultural production, processing of agricultural products and fisheries and aquaculture. More information on the scheme can be found here.

Processing – Supply chain

Investment projects in the field of processing, other than the processing of agricultural products, and the creation of logistics facilities are eligible. More information on this scheme can be found here.

Business extroversion

Refers to investment projects for the development of entrepreneurial extroversion and export activities.

Enhancement of tourism investments

Support is provided for the creation, expansion and modernisation of integrated tourist accommodation and camping sites throughout the Greek territory in order to improve the quality of the tourist product. Find out more about this scheme here.

Alternative forms of tourism

The included investment projects concern alternative forms of tourism and target the exploitation and promotion of the particular characteristics of the country’s regions, such as geographical, social, cultural and religious.

Major Investments

The aid concerns major investment projects with a budget exceeding fifteen million (15.000.000) euros, with the exception of those falling under the aid schemes of a) agri-food – primary production and processing of agricultural products – fisheries b) support for tourism investments and c) alternative forms of tourism.

European value chains (EVCs)

It supports investment projects in the fields of European strategic value chains (microelectronics, high-performance computing, accumulators, interconnected and autonomous vehicles, cybersecurity, personalized medicine and health, low-carbon industry, hydrogen, Internet of Things).

Entrepreneurship 360°

The purpose of the scheme is to support all investment projects covered by the Development Law (except for certain categories for which special schemes are established), which concern the implementation of initial investments and the realisation of additional expenses, for the benefit of business initiatives and the national economy. See here for more information on this scheme.

Nature of Investment Projects

- Establishment of a new unit

- Capacity expansion of an existing unit

- diversification of a unit’s production into goods or services that have never been produced in that unit

- Fundamental change of the whole production process

Eligible categories of investment projects

Law 4887/2022 supports investment projects in all sectors of the economy.

The following is an indicative presentation of eligible activities:

- Investments in the Processing sector (establishment, modernization, or expansion of industrial units

- Investments in the Tourism sector (Establishment or expansion of hotels of at least 4*, modernization of main and secondary tourist accommodation, provided that they belong or are upgraded to at least 3* category, establishment and modernization of tourist accommodation under certain conditions (guesthouses, implementation within traditional settlements in specific areas, classification of 5 keys, capacity of at least 20 rooms), 3* camping, glamping, condo hotels, youth hostels, alternative tourism, diving tourism, conference centers, golf courses, tourist ports, ski resorts, theme parks, thalassotherapy centers, spa centers, Sports- Tourism Training Centers, shelters, motorways, etc.)

- Investments in the Agri-food (Primary production and processing of agricultural products)

- Investments in the field of Sports and leisure activities (Swimming pool services, Football, basketball and tennis courts, etc.)

- Investments in the sector of Storage and auxiliary transport activities (marina services, waterway operation services) and logistics- supply chain management services, parking services

- Libraries and Museums

- In the media and communications sector, the creation of permanent “studios” for the production of films, videos, television programs and recordings is being strengthened.

- In the real estate management sector, investment projects in the field of property management are exceptionally supported for companies developing and managing Organized Hosts of Manufacturing and Business Activities provided that they administer and manage only one.

- Investments in Other Sectors (creation of Recovery and Rehabilitation centers, provision of Assisted Housing for Disabled People, Nursing Homes, Oil & LPG Wholesale Trade implemented on islands, creation of storage facilities, Wholesale Trade of Pharmaceutical Products, Laundry Services, Ironing Services, etc.)

Types of Aid

The following types of aid are provided to investment projects, which fall under the aid schemes of the new development law:

- Tax exemption

- Grant

- Leasing Subsidy

- Subsidy for the costs of new employment

- Risk financing, relating to the “New Entrepreneurship” scheme.

Minimum Budget of Investment plans

The minimum eligible investment amount for the inclusion of investment projects in the aid schemes is determined on the basis of the size of the entity, i.e:

- one million (€1,000,000) for large enterprises

- five hundred thousand (€ 500,000) for medium-sized enterprises

- two hundred and fifty thousand (€250,000) euros for small enterprises, an amount of one hundred thousand (€100,000) for very small enterprises,

- fifty thousand (€50,000) euros for Cooperative Enterprises

Special Aid Categories

The aid rate in the form of a grant is set at 80% of the Regional Aid Map. For a company to receive an aid rate of 100% of the rate set out in the Regional Aid Map, and depending on the aid scheme concerned, it must fall into at least one of the following cases:

- Implement an investment project eligible for submission under the New Entrepreneurship scheme or the Just Transition scheme*.

- Implement an investment project in specific areas as defined in a relevant annex of the Law (mountainous, island, border areas, affected by natural disasters).

- in Industrial and Business Areas (IBAs), Business Parks (BPs), excluding Intermediate Business Parks (IBAs), technology parks and Innovative Activity Hosts (IAHCs) and Organized Manufacturing and Business Activity Hosts (MABHs), provided that they do not concern the modernization or expansion of existing structures of the assisted entity,

- Implement an investment project in buildings classified as listed (90% of the Regional Aid Map).

- Implement an investment project involving the reopening of industrial units that have ceased to operate and the value of the fixed equipment of the industrial unit to be reopened covers at least fifty percent (50%) of the supported cost of the investment project.

To be eligible to apply for aid in the form of a grant, a company must be a Micro or Small Enterprise. Especially for the areas belonging to the Delignification Zones, according to Law no. 4759/2020 (Florina, Kozani, Megalopolis), a combination of grant aid and tax exemption may be provided for medium-sized enterprises; the same will apply, subject to restrictions, to investment projects implemented by medium-sized enterprises in the regional units of Rodopi, Evros and Xanthi.

Note: For the ‘Just Transition Plan’ scheme, the aid rates for the eligible costs of the initial investment are granted on the maximum aid intensities of the Regional Aid Map, regardless of the size of the operator.

Eligible Expenses

- Investment expenses in tangible assets

- construction, expansion, modernisation of buildings, special and auxiliary facilities,

- the purchase of all or part of the existing fixed assets of a business establishment, such as buildings, machinery and other equipment,

- the purchase and installation of new modern machinery and other equipment, including technical installations and means of transport moving within the premises of the integrated unit.

- lease payments for the leasing of new modern machinery and other equipment, the use of which is obtained, provided that the leasing contract specifies that the equipment becomes the property of the lessee at the end of the contract.

- modernisation of specific installations (other than buildings) and mechanical installations.

- Investment expenses in intangible assets

- transfer of technology through the acquisition of patent rights, licenses, patents, know-how or unpatented technical knowledge;

- quality control and assurance systems, certification, procurement and installation of software and business organization systems.

- Eligible expenses outside Regional Aids

- Advisory services to SMEs. Only new small and medium-sized enterprises are eligible for aid up to €50,000 (up to 5% of total eligible costs).

- Start-up costs for newly established and in the process of being established small and micro enterprises and up to 20% of the supported costs with a maximum of 200,000 euros. For innovative small and micro enterprises, the thresholds are doubled.

- Research and development projects (expenditure on staff, buildings, instruments, equipment, etc.)

- Innovation expenditures for SMEs referring to a budget of up to 20% of the total supported costs and up to €200,000.

- Costs for procedural and organizational innovation with a budget of up to 10% of the total supported costs and up to €100,000.

- Costs on environmental protection

- Investment costs for energy efficiency measures.

- Investment costs for high-efficiency cogeneration from renewable energy sources.

- Expenditures for renewable energy production

- Expenditures on the installation of efficient district heating and cooling systems

- Expenditures for the restoration of contaminated sites

- Expenditures for reuse and recycling of waste

- Costs of vocational training

- Expenditures for the participation of SMEs to trade fairs.

- Benefits for disadvantaged employees

Contribution to the cost of the investment project

The financial contribution of each entity to the cost of the investment project may be covered either by their own funds or by external financing, provided that 25 % of the supported costs do not contain any State aid, public support, or public provision.

Submission of Investment Projects

The application and approval process will be conducted electronically.

The application and the required supporting documents must be submitted through the Development Laws Information System

Contact us- https://www.anaptyxiakos.gr

- https://www.ependyseis.gr

- http://www.ypoian.gr

- http://www.investingreece.gov.gr